proposed estate tax changes october 2021

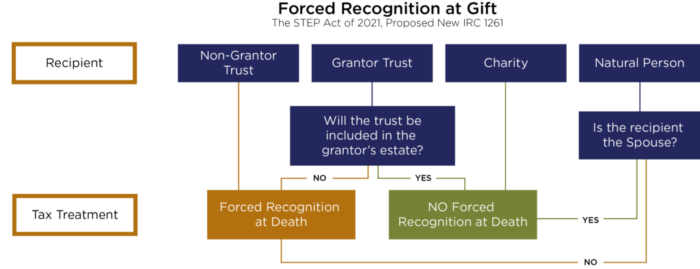

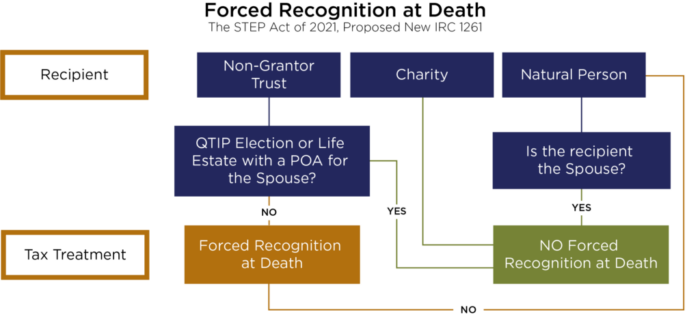

The taxable estate is taxed at 40. On Sunday September 12 2021 the House Ways Means Committee the Committee released draft legislation as part of Congress ongoing 35 trillion budget reconciliation process.

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3.

. The price of democracy is vigilance - Senator Bob Smith D Middlesex Chairman of the NJ. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. State Senate Committee on the Environment.

The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to. Oregon Supreme Court upholds including out-of-state QTIP trust in surviving spouses estate In Estate of Evans v. April 20 2021 Four is the new big number in Piscataway.

That is only four years away and. An alternative sales tax rate of 6625 applies in the tax region Middlesex. The bill would dramatically reduce the federal estate and gift tax exclusion from its current level of 117.

All property tax relief. Stepped-up basis refers to having the propertys usual inherited basis increased or. Property Tax DeductionCredit Eligibility Requirements.

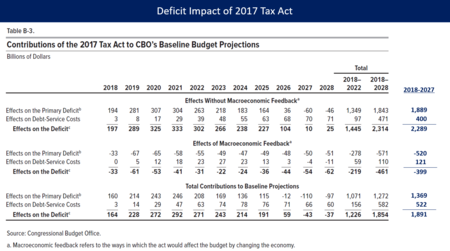

Is 117 million in 2021. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption.

Basis represents for tax purposes the original cost or capital investment for a property. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes.

October 13 and Friday October 14 2022 for maintenance and will reopen Monday October 17 2022. 4089 was referred to the. Reduction in Estate and Gift Tax Exclusion.

Kennedy CPA MBA Vice President Director of Tax Services. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Proposed tax law changes pose major impact on estate planning. But it wouldnt be a surprise if the estate tax. Lothes Sep 24 2021.

Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate. The exemption applies to total bequests. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Starting January 1 2026 the exemption will return to 549 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Will Congress Reshape The Tax Landscape Bernstein

Tax Cuts And Jobs Act Of 2017 Wikipedia

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

2020 Estate Planning Update Helsell Fetterman

Biden Tax Plan Details Analysis Biden Tax Resource Center

Tax Changes For 2022 Kiplinger

Farmers Concerned About Possible Changes In Estate Tax Policy Ag Barometer Agfax

Estate Tax In The United States Wikipedia

Farmers Concerned About Possible Changes In Estate Tax Policy Ag Barometer Agfax

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

State Individual Income Tax Rates And Brackets Tax Foundation

2022 State Tax Reform State Tax Relief Rebate Checks

Year End Tax Planning Guide 2021 Aldrich Cpas Advisors

To Climb Tax Rankings Minnesota Can Reform Its Property Tax Base American Experiment